The increase takes effect from today

Ulster Bank has announced a rate increase of between 0.4% and 0.9% on fixed rate products in the Republic of Ireland.

Variable rates are not changing however Ulster Bank’s Loyalty variable rates will be removed from sale. These changes will take effect from Friday, 24 February 2023.

As part of its phased withdrawal from the Republic of Ireland, Ulster Bank had previously announced that it was no longer accepting applications for mortgages from customers from 10 June 2022, except from existing tracker and offset customers.

Increases announced on Ulster Bank fixed rate mortgage interest rates are:

- 0.9% on two-year fixed rate mortgage

- 0.6% on four-year fixed rate and four year fixed green mortgage

- 0.4% on seven-year fixed rate mortgage

Ulster Bank’s Loyalty variable rate has to date been available to customers who had an income mandated to an Ulster Bank current account. Its removal from sale will not impact those customers who already have a Loyalty variable rate mortgage.

For existing customers who have either applied for a fixed rate and are awaiting a loan offer or who have not yet completed their product switch, the original rates will be honoured by Ulster Bank.

Customers with fixed rates expiring on 31 March 2023 will be able to access the original rates up to the date of expiry of their current rate, in recognition of the fact that they may have planned to select one of our existing rates but may not have actioned that yet.

|

Mortgage Product |

Up to 60% LTV |

Up to 80% LTV |

Up to 90% LTV |

|

2-year fixed |

3.85% |

3.90% |

4.05% |

|

4-year fixed |

3.70% |

3.80% |

3.90% |

|

4-year Green Mortgage |

3.60% |

3.70% |

3.80% |

|

7-year fixed |

3.95% |

4.10% |

4.30% |

Athy To Allenwood: New TFI 888 Bus Route Will Launch On June 3rd

Athy To Allenwood: New TFI 888 Bus Route Will Launch On June 3rd

Single Ticket Now Links Maynooth Rail Line To Dublin Airport Via Aircoach

Single Ticket Now Links Maynooth Rail Line To Dublin Airport Via Aircoach

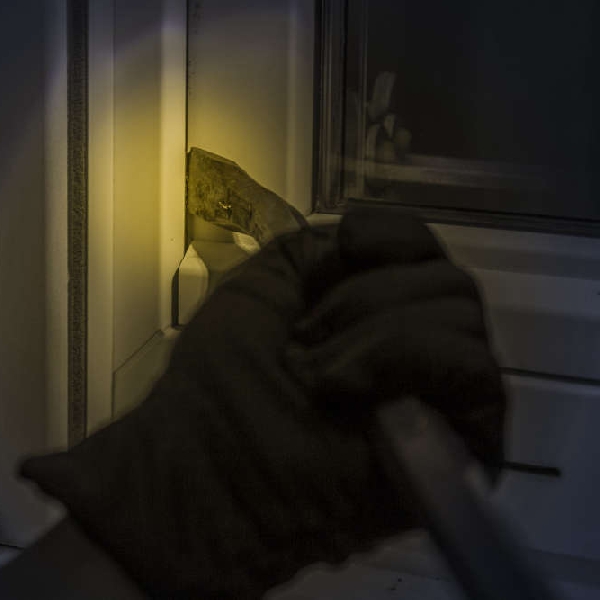

Terror At 4AM: Maynooth Mother Pushed To Ground After Confronting Masked Males During Home Invasion

Terror At 4AM: Maynooth Mother Pushed To Ground After Confronting Masked Males During Home Invasion

Newbridge School Project Sparked Global Journey: Kildare Lawyer Tells Of West Bank Land Grabs

Newbridge School Project Sparked Global Journey: Kildare Lawyer Tells Of West Bank Land Grabs

Hospital Board CEO Has "No Faith" In BAM: Kill-Based Firm Blamed For 15th Children's Hospital Delay

Hospital Board CEO Has "No Faith" In BAM: Kill-Based Firm Blamed For 15th Children's Hospital Delay

Kneecap Condemns Terrorism Charge As ‘Political Policing’

Kneecap Condemns Terrorism Charge As ‘Political Policing’

Driving Test Backlog In Kildare: New Centres And Examiners Promised

Driving Test Backlog In Kildare: New Centres And Examiners Promised

UPDATE: Athy Midwifery Clinic To Reopen Next Week, Women Notified And Midwife Staff To Be Boosted

UPDATE: Athy Midwifery Clinic To Reopen Next Week, Women Notified And Midwife Staff To Be Boosted